Embark on a journey through the intricacies of Automotive Insurance Quote Optimization: What Netherlands Drivers Should Know. This informative piece delves into the essential aspects that every driver in the Netherlands should be aware of, shedding light on the nuances of insurance quotes and optimization strategies.

Exploring the realm of automotive insurance in the Netherlands unveils a myriad of factors that influence insurance quotes and the various options available to drivers seeking optimal coverage.

Overview of Automotive Insurance in the Netherlands

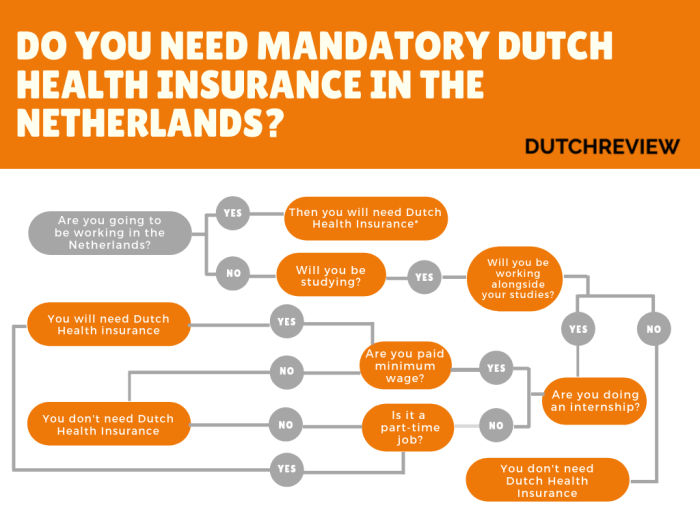

Having automotive insurance is crucial for drivers in the Netherlands as it provides financial protection in case of accidents, theft, or damage to vehicles. It is mandatory by law to have at least third-party liability insurance to cover any damages caused to others in the event of an accident.

Legal Requirements for Drivers in the Netherlands

In the Netherlands, all drivers are required to have at least third-party liability insurance, also known as Wettelijke Aansprakelijkheidsverzekering (WA) in Dutch. This insurance covers the costs of damage to others’ property or injuries in case of an accident where the driver is at fault.

Types of Automotive Insurance Available

There are different types of automotive insurance available in the Netherlands, including:

- Third-Party Liability Insurance (WA): Covers damages to others’ property or injuries caused by the driver.

- Third-Party Liability Plus Insurance (WA+): Offers additional coverage, such as theft, fire, and glass damage.

- Comprehensive Insurance (All-Risk): Provides the most extensive coverage, including damages to own vehicle in addition to third-party coverage.

Benefits of Comprehensive Insurance vs. Third-Party Insurance

- Comprehensive Insurance:

- Covers damages to your vehicle, even if you are at fault in an accident.

- Provides coverage for theft, vandalism, weather-related damage, and other non-collision incidents.

- Offers peace of mind knowing your vehicle is protected in various situations.

- Third-Party Insurance:

- Meets the legal requirements for driving in the Netherlands.

- Generally cheaper than comprehensive insurance.

- Provides basic coverage for damages to others’ property or injuries.

Factors Affecting Insurance Quotes

When it comes to determining automotive insurance quotes in the Netherlands, several factors come into play that can significantly impact the premiums that drivers have to pay. Understanding these factors is crucial for drivers to make informed decisions when choosing their insurance coverage.

Driver’s Age and Driving Experience

The age and driving experience of the driver are key factors that insurance companies consider when calculating insurance premiums. Younger and less experienced drivers are often seen as higher risk due to their lack of experience on the road, which can result in higher insurance costs.

On the other hand, older and more experienced drivers may benefit from lower premiums as they are perceived as less likely to be involved in accidents.

Type of Vehicle

The type of vehicle being insured also plays a significant role in determining insurance costs. High-performance or luxury vehicles typically come with higher insurance premiums due to the increased cost of repairs or replacements in case of an accident. On the other hand, more affordable and practical vehicles may result in lower insurance rates.

Location and Driving Record

The location where the driver resides and their driving record are crucial factors that insurance companies take into account. Drivers living in urban areas with high traffic congestion or high rates of accidents may face higher insurance premiums. Additionally, drivers with a history of accidents or traffic violations are considered higher risk and may be charged more for insurance coverage.

Optimizing Insurance Quotes for Netherlands Drivers

In order to reduce insurance premiums and save money, drivers in the Netherlands can consider several strategies and options that can help optimize their insurance quotes.

Benefits of Bundling Insurance Policies

By bundling multiple insurance policies, such as auto and home insurance, with the same provider, drivers in the Netherlands can often benefit from discounts and cost savings. This approach not only simplifies the insurance process but also helps in reducing overall premiums.

No-Claims Bonus

One way to lower insurance premiums is by building up a no-claims bonus. This bonus rewards drivers for not making any claims over a certain period of time. The longer a driver goes without making a claim, the higher the discount on their insurance premium.

Increasing Deductibles

Another option for Netherlands drivers to consider is increasing deductibles. By opting for a higher deductible amount, drivers can lower their insurance costs. However, it’s important to weigh the potential savings against the out-of-pocket expenses in the event of a claim.

Comparison of Insurance Providers

When it comes to choosing an automotive insurance provider in the Netherlands, it’s important to consider the coverage options, pricing, customer reviews, and claim process. Here is a comparison of popular insurance companies in the Netherlands:

Popular Insurance Companies

- Centraal Beheer

- Ohra

- ANWB

- FBTO

Coverage Options and Pricing

- Centraal Beheer offers comprehensive coverage with competitive pricing.

- Ohra provides customizable insurance packages to fit individual needs.

- ANWB offers discounts for members and various coverage options.

- FBTO is known for its flexible coverage plans and affordable prices.

Customer Reviews and Satisfaction Ratings

- Centraal Beheer has received positive reviews for its excellent customer service.

- Ohra is praised for its quick claim processing and responsive support.

- ANWB customers appreciate the company’s roadside assistance and efficient claims handling.

- FBTO is known for its user-friendly online platform and transparent policies.

Claim Process and Customer Service

- Centraal Beheer has a straightforward claim process and dedicated customer support.

- Ohra offers 24/7 assistance for claims and emergencies.

- ANWB provides a hassle-free claims process and guidance throughout the entire process.

- FBTO ensures quick claim resolution and personalized customer service.

Closure

In conclusion, Automotive Insurance Quote Optimization: What Netherlands Drivers Should Know encapsulates the key considerations for drivers navigating the realm of insurance. By understanding the factors affecting insurance quotes and employing optimization techniques, drivers can make informed decisions to safeguard their vehicles and finances.

Clarifying Questions

What are the legal requirements for drivers in the Netherlands?

Drivers in the Netherlands are required to have at least third-party liability insurance to cover damages to others.

How can drivers reduce insurance premiums in the Netherlands?

Drivers can reduce premiums by increasing deductibles, bundling insurance policies, and maintaining a good driving record.

What is a no-claims bonus?

A no-claims bonus is a discount offered by insurance companies for each year that a driver does not make a claim on their insurance policy.