Delving into the realm of Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing?, this opening paragraph aims to draw in readers with a captivating overview of the topic.

The following paragraph will provide a detailed and informative discussion about the subject matter.

Overview of Automotive Insurance in Saudi Arabia

Automotive insurance is a form of protection that provides financial coverage against physical damage or bodily injury resulting from traffic collisions and against liability that could arise from incidents in a vehicle. In Saudi Arabia, having automotive insurance is mandatory for all vehicle owners to ensure financial protection in case of accidents.

Current Automotive Insurance Landscape in Saudi Arabia

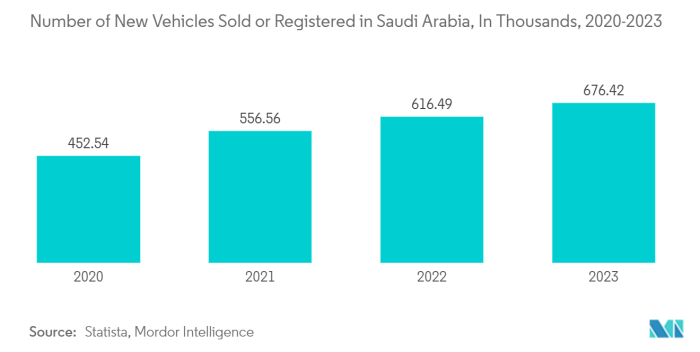

The automotive insurance industry in Saudi Arabia is witnessing significant growth, with a wide range of insurance companies offering various coverage options to cater to the diverse needs of vehicle owners. The market is competitive, driving insurers to offer innovative products and services to attract customers.

- Insurance companies in Saudi Arabia provide comprehensive, third-party, and other specialized insurance policies tailored to meet the specific requirements of vehicle owners.

- There is a growing trend towards digitalization in the automotive insurance sector, with insurers offering online platforms for policy purchase, renewal, and claims processing, making the process more convenient for customers.

- The Saudi Arabian government has implemented regulations to ensure that all vehicles on the road are insured, leading to increased awareness among the population about the importance of having automotive insurance.

Importance of Having Automotive Insurance in Saudi Arabia

Having automotive insurance in Saudi Arabia is crucial for several reasons:

- It provides financial protection in case of accidents, covering the cost of repairs or medical expenses that may arise due to a collision.

- It is a legal requirement mandated by the government to ensure that all vehicle owners take responsibility for any damages or injuries they may cause while driving.

- Automotive insurance offers peace of mind to vehicle owners, knowing that they are financially protected in case of unforeseen events on the road.

Factors Influencing Automotive Insurance Quotes

When it comes to determining automotive insurance quotes in Saudi Arabia, several key factors play a crucial role in influencing the final pricing. These factors can vary from individual to individual and can significantly impact the cost of insurance premiums.

Age

Age is a critical factor that insurance companies consider when calculating insurance quotes. Younger drivers, especially those under the age of 25, are typically charged higher premiums due to the perception of higher risk associated with their age group. On the other hand, older drivers with more experience tend to receive lower insurance quotes.

Gender

In Saudi Arabia, gender also plays a role in determining insurance quotes. Historically, male drivers have been charged higher premiums than female drivers due to statistical data showing that male drivers are more likely to be involved in accidents. However, recent trends are shifting towards gender-neutral pricing in some insurance companies.

Driving History

A driver’s past driving record is a significant factor that affects insurance quotes. Individuals with a history of accidents or traffic violations are considered higher risk drivers and are charged higher premiums. On the other hand, drivers with a clean record are rewarded with lower insurance quotes.

Type of Vehicle

The type of vehicle being insured also has a direct impact on insurance pricing. Luxury cars, sports cars, and high-performance vehicles typically come with higher insurance premiums due to their higher repair costs and increased risk of theft. On the other hand, economy cars and vehicles with advanced safety features may qualify for lower insurance quotes.

Unique Factors in Saudi Arabia

In Saudi Arabia, there are some unique factors that influence insurance pricing. For example, the region’s extreme weather conditions, such as sandstorms and high temperatures, can lead to increased wear and tear on vehicles, resulting in higher insurance premiums. Additionally, the prevalence of off-road driving and congested urban areas may also impact insurance pricing in the country.

Emerging Trends in Automotive Insurance Quotes

In recent years, the landscape of automotive insurance quotes in Saudi Arabia has been evolving rapidly, driven by various emerging trends.

Advancements in Technology and Insurance Pricing

The integration of technology in the insurance industry has greatly impacted the pricing of automotive insurance quotes. Insurers are now leveraging telematics devices and data analytics to assess individual driving behaviors and offer personalized insurance premiums. This usage-based insurance approach is becoming increasingly popular, allowing safer drivers to benefit from lower rates based on their actual driving habits.

New Offerings and Products in Automotive Insurance

Another trend shaping automotive insurance quotes in Saudi Arabia is the introduction of new offerings and products by insurance companies. For example, some insurers are now providing coverage for additional risks such as cyber-attacks on connected vehicles or damage to autonomous driving technology.

These innovative products cater to the changing needs of drivers in the era of smart cars and connected technologies.

Comparison with Global Trends

In comparing the automotive insurance trends in Saudi Arabia with global trends, it is essential to look at the similarities and differences in the factors influencing insurance pricing, as well as how Saudi Arabia’s automotive insurance market aligns with international standards.

Factors Influencing Insurance Pricing

- Similarities: Both in Saudi Arabia and globally, factors such as the driver’s age, driving experience, type of vehicle, and claims history play a significant role in determining insurance premiums. These factors are commonly considered by insurers worldwide to assess risk and calculate pricing.

- Differences: One notable difference is that in some countries, credit score and gender may also impact insurance rates, which may not be as prevalent in Saudi Arabia. Additionally, local regulations and market dynamics can vary, leading to differences in pricing strategies.

Alignment with International Standards

- Saudi Arabia’s automotive insurance market is increasingly aligning with international standards in terms of adopting technology-driven solutions for pricing, underwriting, and claims processing. Insurtech innovations are being integrated to enhance efficiency and customer experience, reflecting a global trend towards digitization in the insurance industry.

- Moreover, Saudi Arabia is moving towards implementing more stringent regulations to ensure consumer protection, promote transparency, and strengthen the overall insurance framework. These efforts are in line with global initiatives aimed at enhancing market stability and sustainability.

Impact of Regulatory Changes

Recent regulatory changes have had a significant impact on the automotive insurance landscape in Saudi Arabia. These changes have influenced insurance pricing, coverage options, and the overall competitiveness of insurance companies in the market.

Impact on Pricing and Coverage

- One of the key effects of regulatory changes is the adjustment of pricing models by insurance companies to comply with new laws or policies. This has led to fluctuations in premium rates for automotive insurance policies.

- Moreover, changes in regulations have also influenced the types of coverage offered to policyholders. Insurance companies have had to adapt their coverage options to align with the updated regulatory requirements.

- Additionally, regulatory shifts have impacted the overall affordability of automotive insurance for consumers, as pricing adjustments and coverage modifications may have made policies more or less accessible based on individual circumstances.

Responsiveness of Insurance Companies

- Insurance companies in Saudi Arabia have demonstrated varying degrees of responsiveness to regulatory changes. Some companies have proactively adjusted their pricing and coverage options to comply with new laws, while others may have been slower to adapt.

- Furthermore, the competitiveness of insurance companies in the market has been influenced by their ability to effectively respond to regulatory shifts. Companies that have been agile in adjusting their strategies have maintained a stronger position in the industry.

- Overall, the responsiveness of insurance companies to regulatory changes plays a crucial role in shaping the automotive insurance landscape in Saudi Arabia and determining the level of service and options available to consumers.

Summary

Concluding with a summary that encapsulates the key points discussed, leaving readers with a lasting impression of the topic.

Popular Questions

What are the factors that influence automotive insurance quotes in Saudi Arabia?

Factors include age, gender, driving history, and type of vehicle, along with unique Saudi Arabian influences on pricing.

How do advancements in technology impact insurance pricing in Saudi Arabia?

Technological advancements can shape pricing by introducing new variables and products to the market.

What is the comparison between automotive insurance trends in Saudi Arabia and global trends?

The comparison identifies similarities and differences in factors affecting pricing, aligning with international standards.

How have recent regulatory changes affected automotive insurance in Saudi Arabia?

Regulatory changes can impact pricing and coverage, prompting insurance companies to adapt to new laws and policies.