Exploring Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this introduction delves into the intricacies of finding affordable insurance solutions for drivers facing higher risks. It provides a comprehensive guide with valuable insights and practical advice to navigate the insurance landscape effectively.

The subsequent paragraph elaborates on the key points discussed in the Artikel, shedding light on important aspects related to high-risk drivers and discount car insurance quotes.

Introduction to High-Risk Drivers

High-risk drivers are individuals who insurance companies deem to have a higher likelihood of being involved in accidents or filing claims, which may result in increased financial risk for the insurer. As a result, these drivers are often charged higher insurance premiums compared to low-risk drivers.

Factors Leading to High-Risk Classification

Several factors can contribute to being classified as a high-risk driver:

- Past Driving Record: A history of traffic violations, accidents, or DUI convictions can signal to insurers that a driver may pose a higher risk on the road.

- Lack of Driving Experience: New drivers or individuals with limited experience behind the wheel may be considered high-risk due to their unfamiliarity with navigating various driving situations.

- Type of Vehicle: Certain types of vehicles, such as sports cars or luxury vehicles, may be associated with higher accident rates, leading to a high-risk classification.

Implications on Insurance Premiums

Being classified as a high-risk driver can have significant implications on insurance premiums:

- Higher Premiums: High-risk drivers typically face higher insurance premiums to offset the increased likelihood of filing claims or being involved in accidents.

- Limited Coverage Options: Some insurance companies may offer limited coverage options to high-risk drivers, which can further impact their ability to find affordable insurance.

- Requirement for SR-22: In some cases, high-risk drivers may be required to obtain an SR-22 form, which certifies that they have the minimum required auto insurance coverage in place.

Understanding Discount Car Insurance Quotes

Discount car insurance quotes are specialized quotes offered to high-risk drivers in Canada. These quotes are tailored to individuals with a history of accidents, traffic violations, or other factors that classify them as high-risk drivers.

Differences from Regular Car Insurance Quotes

Discount car insurance quotes differ from regular car insurance quotes in that they take into account the higher risk associated with the driver. This often means that the premiums may be higher, but they are still more affordable compared to standard rates for high-risk drivers.

These quotes may also come with specific conditions or restrictions based on the driver’s history.

Benefits of Seeking Discount Car Insurance Quotes

- Cost-Effective: Discount car insurance quotes offer a more affordable option for high-risk drivers compared to standard rates.

- Customized Coverage: These quotes are tailored to the specific needs of high-risk drivers, providing coverage that meets their unique requirements.

- Potential Savings: By exploring discount car insurance quotes, high-risk drivers may find ways to save money on their premiums while still maintaining adequate coverage.

Tips for High-Risk Drivers in Canada

High-risk drivers in Canada face challenges when it comes to finding affordable car insurance. However, there are strategies and options available to help improve their situation. Here are some tips for high-risk drivers in Canada:

Insurance Companies Offering Discounts

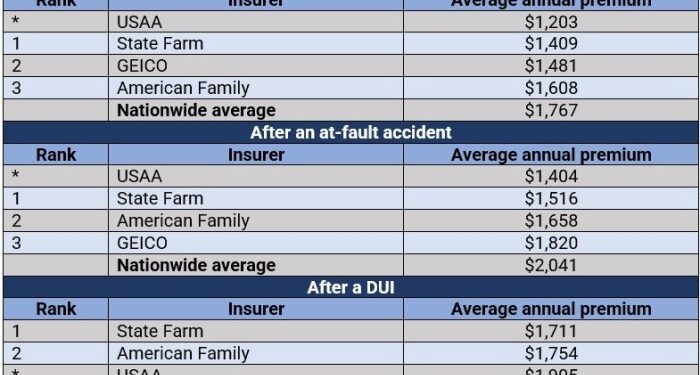

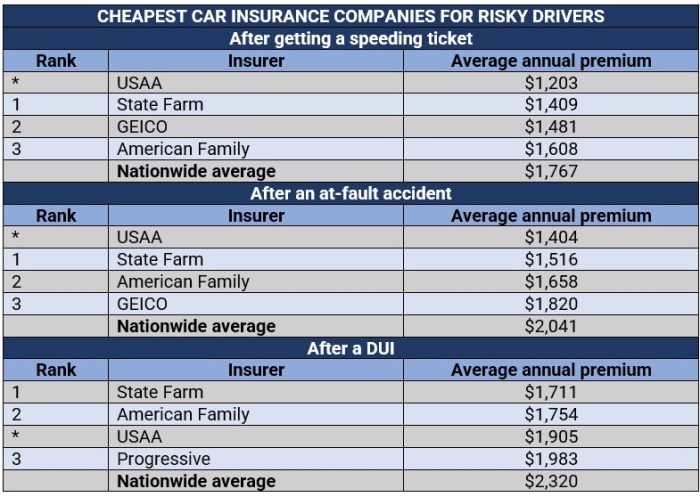

It’s essential for high-risk drivers to research and compare insurance companies in Canada that offer discounts specifically for drivers with less-than-perfect driving records. Some of the companies that are known to provide discounts for high-risk drivers include:

- Intact Insurance

- Belairdirect

- Desjardins Insurance

- TD Insurance

Improving Driving Record

One of the most effective ways for high-risk drivers to qualify for discounts is by improving their driving record. This can be achieved by:

- Enrolling in a defensive driving course

- Following traffic laws and regulations

- Avoiding speeding tickets and traffic violations

- Using telematics devices to monitor driving habits

Comparing Quotes from Multiple Providers

High-risk drivers should always compare quotes from multiple insurance providers to ensure they are getting the best deal possible. By obtaining quotes from different companies, drivers can find the most competitive rates and coverage options tailored to their specific needs.

Additional Factors to Consider

When it comes to obtaining discount car insurance for high-risk drivers in Canada, there are several additional factors to consider that can impact insurance premiums and negotiations with providers.

Role of Telematics Devices

Telematics devices, such as GPS trackers or apps that monitor driving behavior, can play a significant role in obtaining discount car insurance for high-risk drivers. By allowing insurance providers to track driving habits like speed, braking, and distance traveled, these devices can help demonstrate safe driving practices and potentially lower insurance premiums for high-risk drivers.

Impact of Choosing Higher Deductibles

Choosing higher deductibles can have a direct impact on insurance premiums for high-risk drivers. While opting for a higher deductible may lower monthly premium costs, it also means that drivers will have to pay more out of pocket in the event of an accident.

High-risk drivers should carefully weigh the potential savings against the financial risk of a higher deductible before making a decision.

Effective Communication with Insurance Providers

High-risk drivers can improve their chances of negotiating better rates with insurance providers by effectively communicating their circumstances and taking proactive steps to mitigate risk. This can include providing evidence of safe driving habits, completing defensive driving courses, and being transparent about any improvements or changes in their driving behavior.

Conclusive Thoughts

Concluding our discussion on Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this summary encapsulates the essence of seeking cost-effective insurance options for those classified as high-risk drivers. It emphasizes the significance of proactive measures and informed decisions in securing suitable coverage.

User Queries

What factors contribute to being classified as a high-risk driver?

High-risk factors include traffic violations, accidents, age, and driving experience.

How can high-risk drivers improve their driving record?

High-risk drivers can take defensive driving courses, obey traffic laws, and maintain a clean driving record to qualify for discounts.

Do all insurance companies in Canada offer discounts for high-risk drivers?

Not all insurance companies provide discounts, so it’s crucial to research and compare quotes from multiple providers to find the best rates.